Pell Grant

The Pell Grant is a federal grant that helps low-income students pay for college. It is the largest federal grant program for higher education, and it provides an average of $6,495 per year to students.

To be eligible for the Pell Grant, you must be a U.S. citizen or permanent resident, and you must have a high school diploma or equivalent. You must also meet certain income requirements.

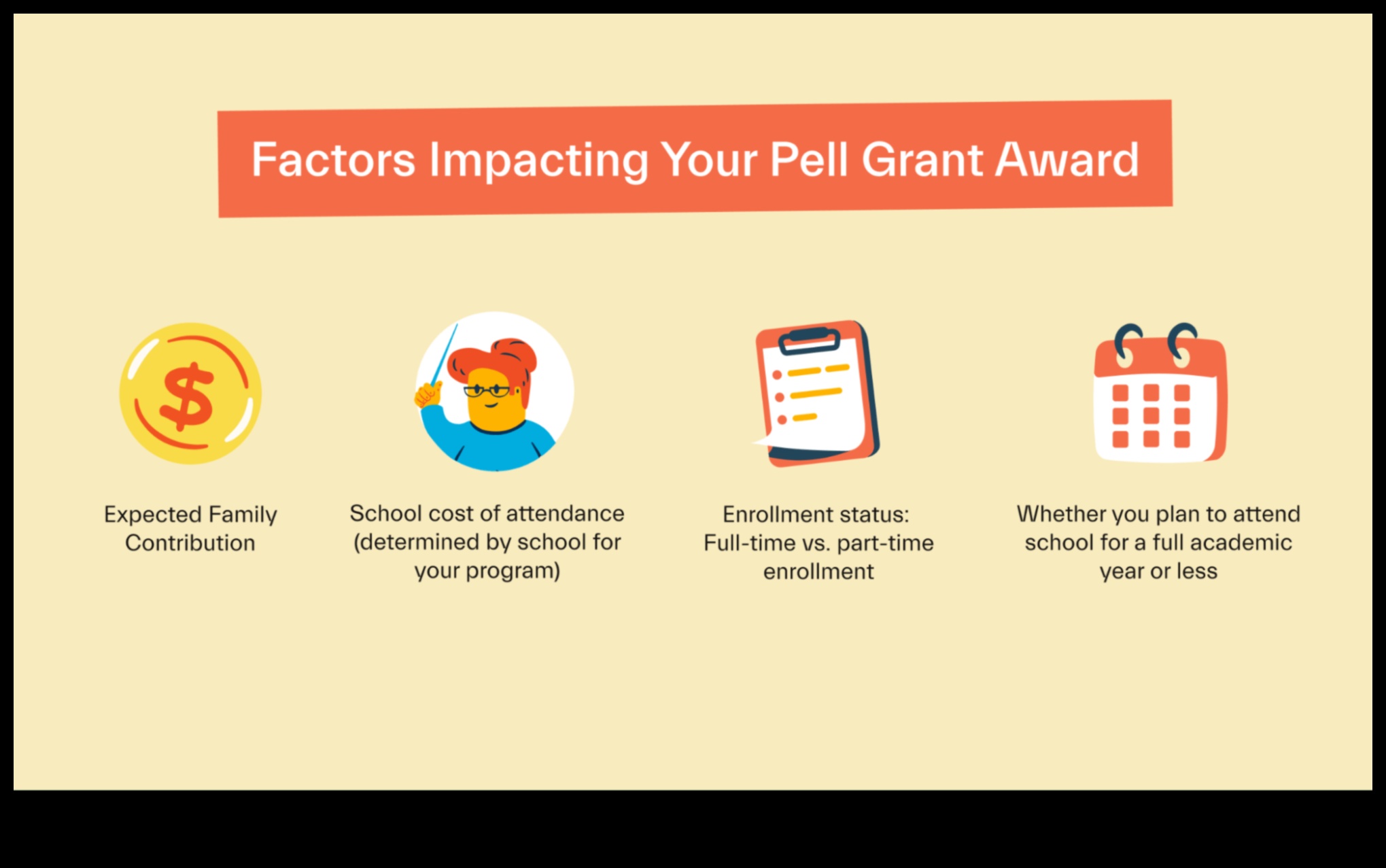

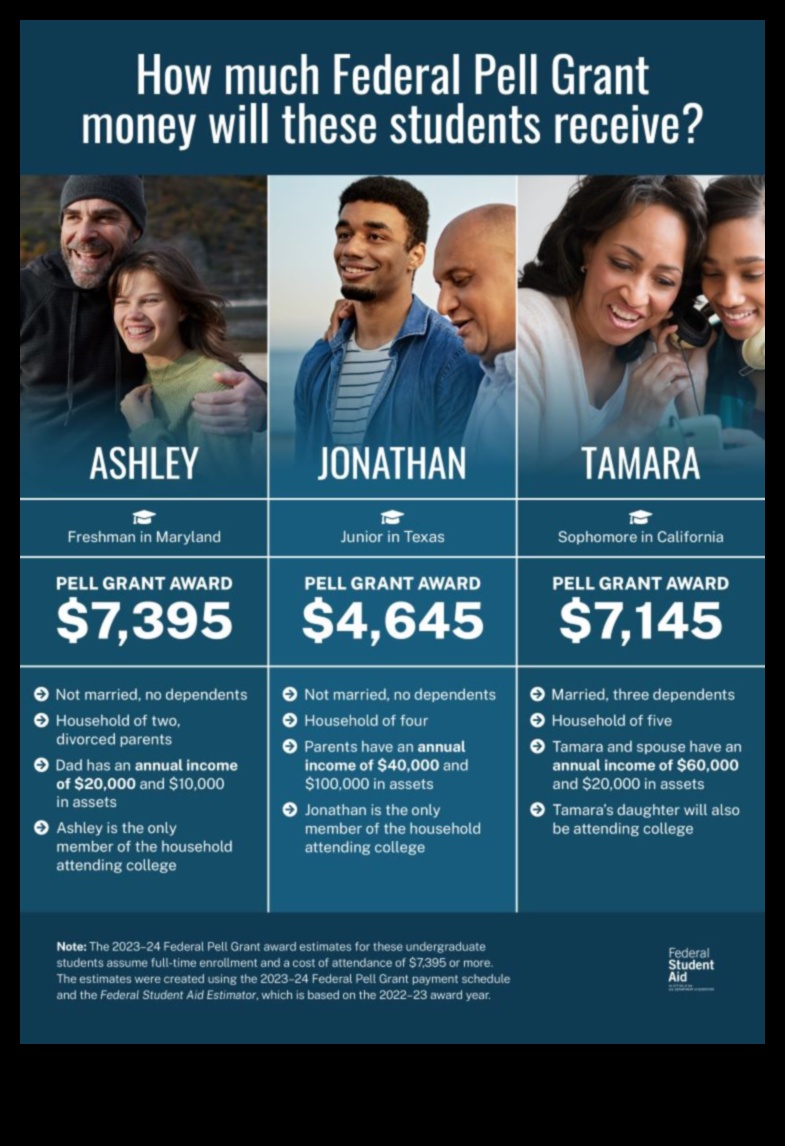

The amount of the Pell Grant you receive depends on your financial need and the cost of attendance at your school. You can find out how much you qualify for by using the FAFSA.

The Pell Grant is a renewable award, which means that you can receive it for up to four years of undergraduate study. However, you must maintain a certain GPA to continue receiving the Pell Grant.

The Pell Grant is a great way to help pay for college. If you are eligible, you should definitely apply for it.

FAQ

* What is the difference between the Pell Grant and the FSEOG Grant?

The Pell Grant is a need-based grant, while the FSEOG Grant is a merit-based grant. The Pell Grant is available to all eligible students, while the FSEOG Grant is only available to students who have a high GPA.

* How do I apply for the Pell Grant?

You can apply for the Pell Grant by filling out the FAFSA. The FAFSA is available starting October 1st of each year.

* What are the requirements for the Pell Grant?

To be eligible for the Pell Grant, you must meet the following requirements:

- You must be a U.S. citizen or permanent resident.

- You must have a high school diploma or equivalent.

- You must meet certain income requirements.

* What are the benefits of the Pell Grant?

The Pell Grant has many benefits, including:

- It can help you pay for college tuition, fees, and other expenses.

- It does not have to be repaid.

- It is a renewable award, which means that you can receive it for up to four years of undergraduate study.

* What are the disadvantages of the Pell Grant?

The Pell Grant has a few disadvantages, including:

- The amount of the Pell Grant you receive depends on your financial need and the cost of attendance at your school.

- You must maintain a certain GPA to continue receiving the Pell Grant.

- The Pell Grant is not available to all students.

* What are the consequences of not repaying the Pell Grant?

If you do not repay the Pell Grant, you may be subject to the following consequences:

- You may be required to pay back the entire amount of the grant.

- You may be charged interest on the amount of the grant.

- You may be denied future federal student aid.

* How can I get help with the Pell Grant?

If you need help with the Pell Grant, you can contact the following resources:

- Your financial aid office

- The FAFSA help line (1-800-43

Feature Answer Pell Grant A federal grant for low-income students to help pay for college costs. Financial aid Money given to students to help pay for college costs. College financial aid Financial aid that is specifically for college students. How to check Pell Grant status You can check your Pell Grant status online or by contacting your financial aid office. Pell Grant eligibility You must be a U.S. citizen or permanent resident, have a high school diploma or equivalent, and be enrolled in a degree or certificate program at least half-time.

What is the Pell Grant?

The Pell Grant is a federal grant that helps low-income students pay for college. It is the largest federal grant program for higher education, and it is awarded based on financial need.

Who is eligible for the Pell Grant?

To be eligible for the Pell Grant, you must be a U.S. citizen or eligible noncitizen, and you must have a high school diploma or equivalent. You must also be enrolled in an eligible degree or certificate program at least half-time.

How much is the Pell Grant?

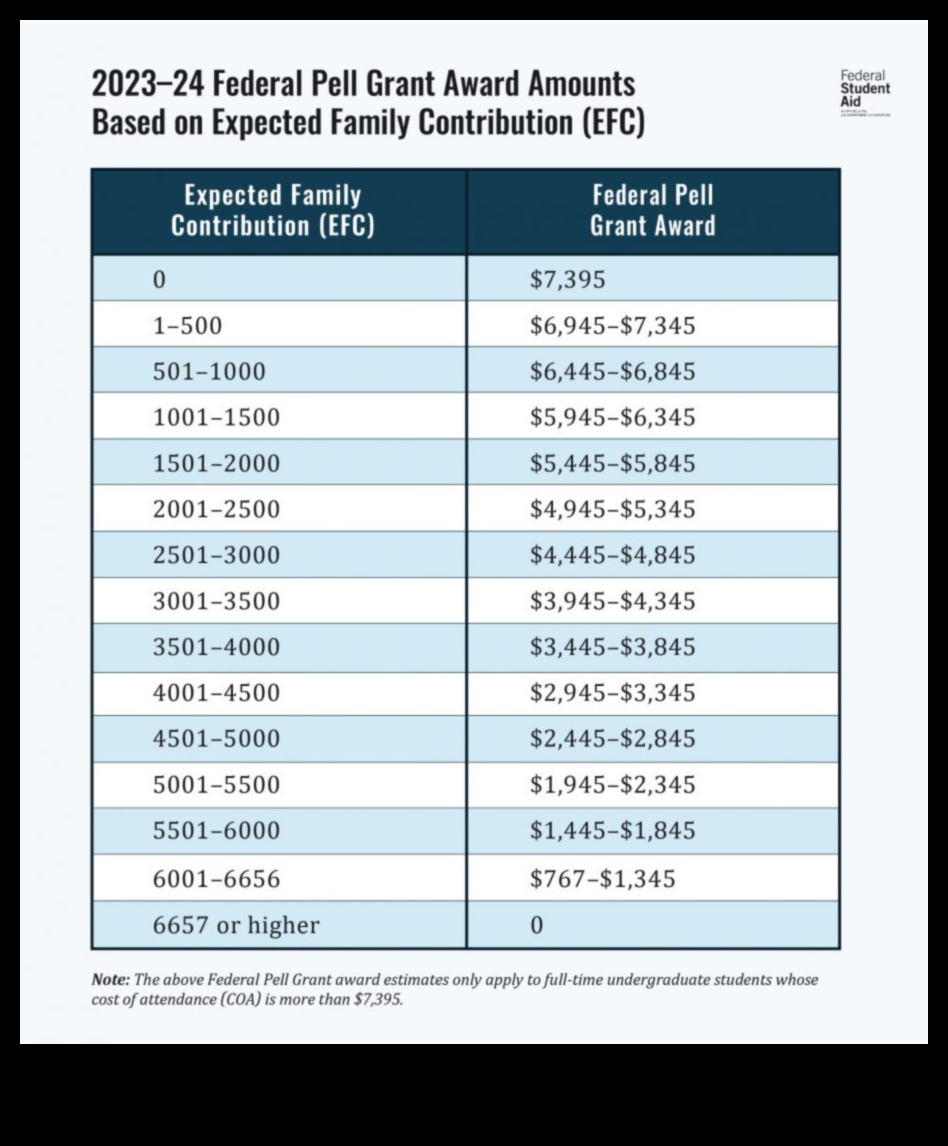

The amount of the Pell Grant you receive depends on your financial need and the cost of attendance at your school. The maximum Pell Grant for the 2022-23 academic year is $6,495.

How do I apply for the Pell Grant?

You can apply for the Pell Grant through the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov.

What are the requirements for the Pell Grant?

To be eligible for the Pell Grant, you must meet the following requirements:

* You must be a U.S. citizen or eligible noncitizen.

* You must have a high school diploma or equivalent.

* You must be enrolled in an eligible degree or certificate program at least half-time.

* Your family income must be below a certain level.

* You must not have a felony conviction.What are the benefits of the Pell Grant?

The Pell Grant can help you pay for college expenses such as tuition, fees, books, and living expenses. It can also help you save money on student loans.

What are the disadvantages of the Pell Grant?

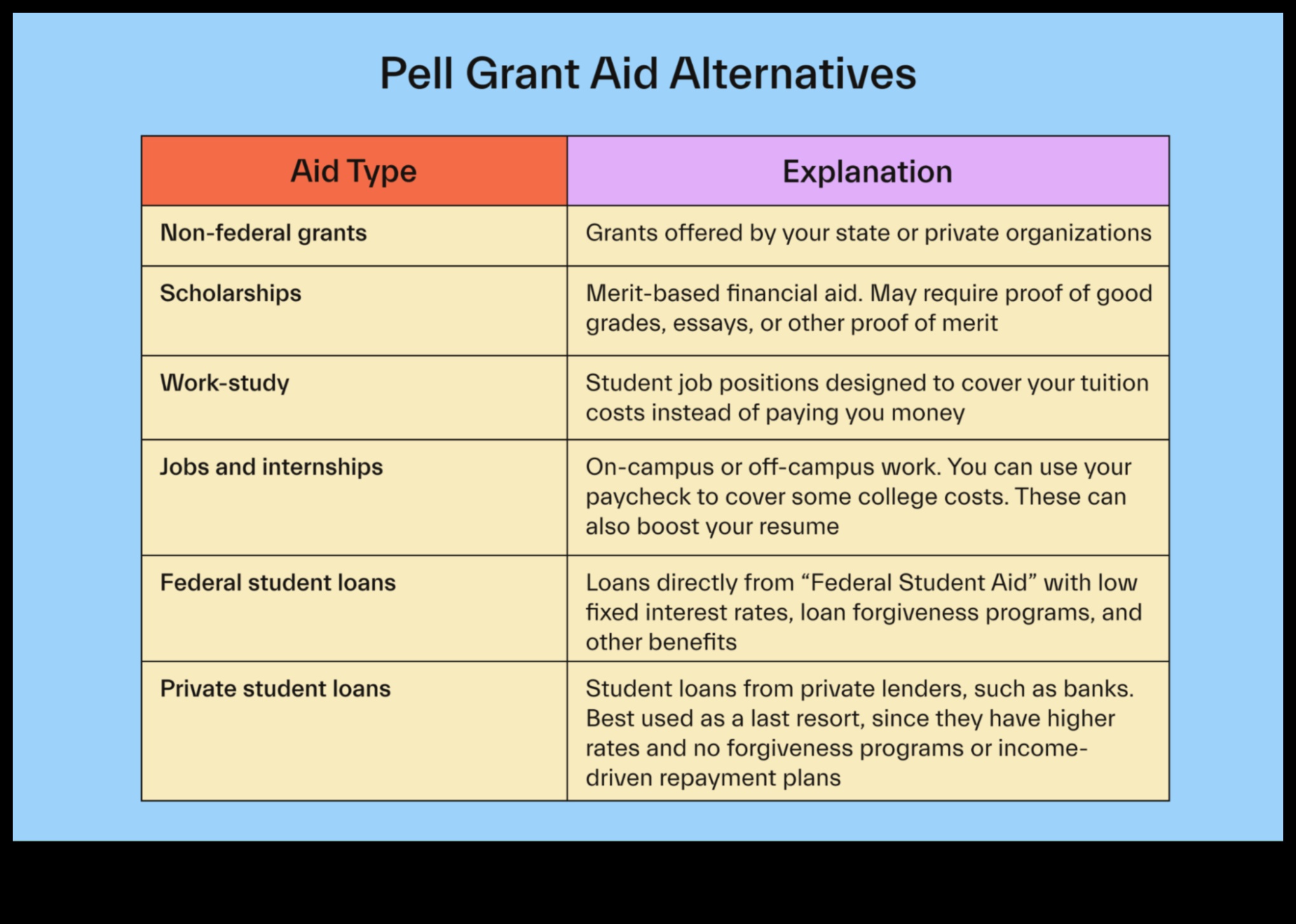

The Pell Grant is a need-based grant, so you may not be eligible if your family income is too high. You also have to repay other types of financial aid, such as student loans, before you can use your Pell Grant.

What are the consequences of not repaying the Pell Grant?

If you do not repay your Pell Grant, you may have to pay back the money with interest. You may also be denied other federal student aid in the future.

How can I get help with the Pell Grant?

If you need help applying for the Pell Grant, you can contact your school’s financial aid office. You can also contact the Federal Student Aid Information Center at 1-800-433-3243.

FAQ

What is the difference between the Pell Grant and the FSEOG Grant? The Pell Grant is a federal grant that is awarded based on financial need. The FSEOG Grant is a federal grant that is awarded to students with exceptional financial need.

Can I get a Pell Grant if I am a graduate student? Yes, you can get a Pell Grant if you are a graduate student who is enrolled in an eligible degree or certificate program at least half-time.

Can I get a Pell Grant if I am a part-time student? Yes, you can get a Pell Grant if you are a part-time student who is enrolled in an eligible degree or certificate program at least half-time.

Can I get a Pell Grant if I am a foreign student? Yes, you can get a Pell Grant if you are a foreign student who is a U.S. citizen or eligible noncitizen and who meets all of the other eligibility requirements.3. How much is the Pell Grant?

The Pell Grant is a need-based federal grant that can help cover the cost of college or career school. The amount of the Pell Grant you receive depends on your financial need and the cost of attendance at your school.

The maximum Pell Grant award for the 2022-2023 academic year is $6,495. However, the amount you actually receive may be less than the maximum if your financial need is lower or if the cost of attendance at your school is higher.

You can use the Pell Grant Estimator to estimate how much you may qualify for.

4. How do I apply for the Pell Grant?

To apply for the Pell Grant, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov. You can also apply for the Pell Grant through your college or university’s financial aid office.

The FAFSA is used to determine your eligibility for federal student aid, including the Pell Grant. When you complete the FAFSA, you will need to provide information about your income, assets, and family size. You will also need to provide information about your educational goals and plans.

The FAFSA is processed on a rolling basis, and awards are made on a first-come, first-served basis. The sooner you submit your FAFSA, the better your chances of being awarded a Pell Grant.

If you are eligible for the Pell Grant, you will receive a Pell Grant award letter from the Department of Education. The Pell Grant award letter will tell you how much money you have been awarded and how you can use it.

5. What are the requirements for the Pell Grant?

To be eligible for the Pell Grant, you must:

- Be a U.S. citizen or eligible noncitizen

- Be enrolled at least half-time in a degree or certificate program at an eligible institution

- Have a financial need

- Meet other requirements, such as satisfactory academic progress

6. What are the benefits of the Pell Grant?

The Pell Grant is a federal grant that provides financial assistance to low-income students who are attending college or university. The grant is awarded based on financial need, and the amount of the grant is determined by the student’s expected family contribution (EFC).

There are many benefits to receiving a Pell Grant, including:

- It can help you pay for college tuition, fees, and other expenses.

- It does not have to be repaid, so you do not have to worry about accumulating debt.

- It can help you save money on interest payments.

- It can help you graduate from college on time.

- It can improve your chances of getting a good job after college.

If you are eligible for the Pell Grant, it is a great way to help pay for college. The grant can make a big difference in your financial situation and help you reach your educational goals.

7. What are the disadvantages of the Pell Grant?

There are a few disadvantages to the Pell Grant that you should be aware of before you apply.

- The Pell Grant is a need-based award, which means that your eligibility is based on your financial need. If your income is too high, you may not qualify for the Pell Grant.

- The Pell Grant is a limited resource, and the amount you receive is based on the number of Pell Grant recipients and the amount of money available. This means that the amount of the Pell Grant you receive may be less than you need to cover your college costs.

- The Pell Grant is not a loan, so you do not have to repay it. However, you must maintain satisfactory academic progress to keep the Pell Grant. If you do not maintain satisfactory academic progress, you may lose your Pell Grant eligibility.

Overall, the Pell Grant is a valuable financial aid award that can help low-income students pay for college. However, it is important to be aware of the disadvantages of the Pell Grant before you apply.

8. What are the consequences of not repaying the Pell Grant?

If you do not repay your Pell Grant, you may face the following consequences:

- You may be required to repay the entire grant amount, plus interest.

- You may be ineligible for future federal student aid.

- Your tax refund may be withheld to help repay the grant.

- You may be subject to wage garnishment or other collection actions.

It is important to note that you do not have to repay your Pell Grant if you drop out of school or if you are unable to complete your degree. However, you may still be responsible for repaying any interest that has accrued on the grant.

If you are struggling to repay your Pell Grant, there are a number of resources available to help you. You can contact your financial aid office for assistance, or you can apply for a deferment or forbearance. You may also be eligible for a loan forgiveness program.

How can I get help with the Pell Grant? There are a few ways to get help with the Pell Grant. You can:

- Contact your school’s financial aid office. They can provide you with information about the Pell Grant and help you apply for the award.

- Visit the Pell Grant website. This website provides information about the Pell Grant, including eligibility requirements, application deadlines, and how to use the award.

- Call the Federal Student Aid Information Center at 1-800-433-3243. This center can answer questions about the Pell Grant and help you with the application process.

FAQ

* What is the Pell Grant? The Pell Grant is a federal grant that helps low-income students pay for college.

* Who is eligible for the Pell Grant? Students who are US citizens or permanent residents, and who have a financial need, are eligible for the Pell Grant.

* How much is the Pell Grant? The amount of the Pell Grant you receive depends on your financial need and the cost of attendance at your school.