Slush Fund

A slush fund is a fund of money that is used for unofficial or undisclosed purposes. Slush funds are often used to pay for bribes, kickbacks, or other illegal or unethical activities.

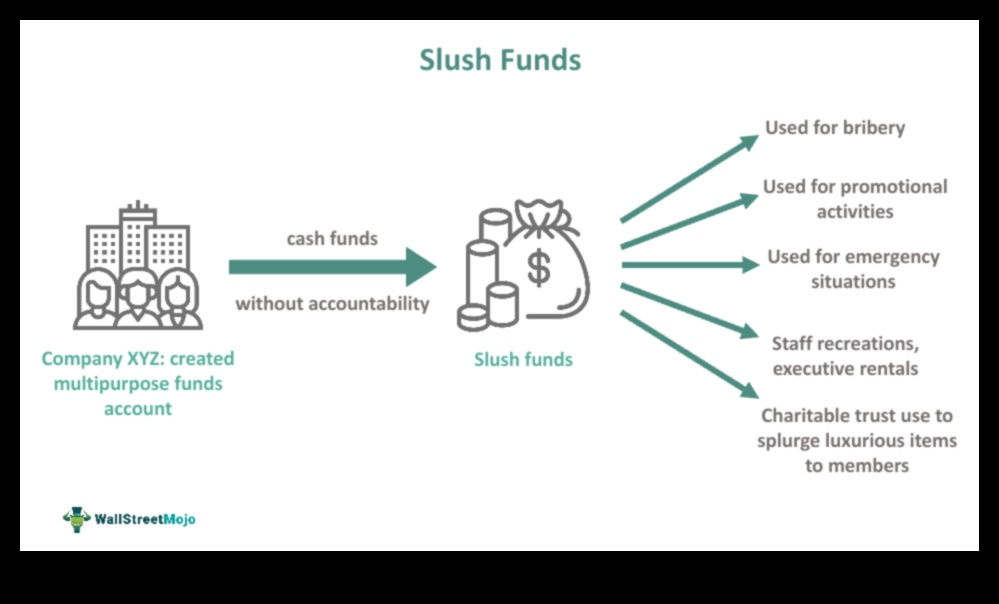

Slush funds can be created by individuals, businesses, or organizations. They can be used for a variety of purposes, including:

- Paying for illegal or unethical activities

- Circumventing taxes

- Influencing political decisions

- Providing secret payments to employees or contractors

Slush funds are often difficult to detect, as they are often hidden from public view. However, there are a number of ways to identify a slush fund, including:

- Excessive spending by an individual or organization

- Unexplained payments to third parties

- A lack of transparency in financial records

- The use of shell companies or other opaque financial structures

Slush funds can have a number of negative consequences, including:

- Corruption

- Financial instability

- Loss of public trust

- Damage to the economy

Slush funds are illegal in most countries. However, they can be difficult to prosecute, as they are often hidden from public view.

If you suspect that a slush fund is being used, you should report it to the authorities.

| Feature | Slush Fund | Corruption | Political Spending | Kickback | Emolument |

|---|---|---|---|---|---|

| Definition | A fund of money used for unofficial or undisclosed purposes | The misuse of public office for private gain | The use of money to influence political outcomes | A payment made to someone in return for a favor | A payment received by a public official in return for an official act |

| Examples | A company sets up a slush fund to pay off government officials | A politician uses campaign funds to pay for personal expenses | A corporation donates money to a political campaign in exchange for favorable legislation | A doctor receives a kickback from a pharmaceutical company for prescribing their drugs | A government official accepts an emolument from a foreign government in exchange for favorable treatment |

| Problems | Slush funds can be used to hide illegal activities | Corruption can lead to poor governance and economic instability | Political spending can lead to unfair elections and government policies | Kickbacks can lead to higher prices and lower quality goods and services | Emoluments can undermine the independence of public officials |

| Solutions | Slush funds should be banned and/or strictly regulated | Corruption should be punished severely | Political spending should be transparent and regulated | Kickbacks should be illegal | Emoluments should be prohibited |

II. History of Slush Funds

Slush funds have been around for centuries. In the early 1900s, they were used by political bosses to bribe voters and buy votes. In the 1920s, they were used by organized crime to launder money. In the 1970s, they were used by corporations to pay for illegal activities. Today, slush funds are still used for a variety of illegal and unethical purposes.

III. Uses of Slush Funds

Slush funds can be used for a variety of purposes, including:

- Paying for illegal or unethical activities

- Bribing public officials

- Circumventing campaign finance laws

- Funding political activities

- Tax evasion

- Money laundering

Slush funds can be very difficult to detect, as they are often hidden from public view. This makes them a popular tool for criminals and corrupt politicians.

IV. Problems with Slush Funds

Slush funds can pose a number of problems for organizations, including:

- Corruption

- Political spending

- Kickbacks

- Emolument

Corruption is a major problem that can be caused by slush funds. When funds are not properly accounted for, it can be difficult to track where the money is going and what it is being used for. This can lead to corruption, as individuals or organizations may use slush funds to pay for personal expenses or to influence decisions.

Political spending is another problem that can be caused by slush funds. Slush funds can be used to make political donations that are not properly disclosed. This can give certain individuals or organizations an unfair advantage in the political process.

Kickbacks are another problem that can be caused by slush funds. Slush funds can be used to pay kickbacks to employees or contractors. This can lead to conflicts of interest and can undermine the integrity of the organization.

Emolument is another problem that can be caused by slush funds. Slush funds can be used to pay for gifts or other benefits to government officials. This can lead to corruption and can undermine the public trust in government.

V. How to Detect Slush Funds

There are a few ways to detect slush funds.

1. Look for unusual or unexplained payments. Slush funds are often used to make payments that are not authorized or that are not properly documented. If you see payments being made to vendors that you don’t recognize, or if you see payments being made for services that were never rendered, this could be a sign of a slush fund.

2. Look for secret bank accounts. Slush funds are often kept in secret bank accounts that are not listed on the company’s financial statements. If you find that the company has a bank account that you don’t know about, this could be a sign of a slush fund.

3. Look for suspicious activity. Slush funds are often used to engage in illegal or unethical activities. If you see evidence of fraud, corruption, or other illegal activity, this could be a sign of a slush fund.

4. Ask questions. If you suspect that a slush fund exists, don’t be afraid to ask questions. Ask your manager or supervisor about the purpose of the fund and the documentation that supports it. If you don’t get satisfactory answers, you can escalate your concerns to the next level of management.

Slush funds can be a serious problem for businesses. By being aware of the signs of a slush fund, you can help to protect your company from this type of fraud.

6. What is the legal definition of a slush fund?

There is no single, universally accepted legal definition of a slush fund. However, most legal definitions of a slush fund include the following elements:

* A slush fund is a fund that is used for unauthorized or undisclosed purposes.

* A slush fund is often used to conceal illegal or unethical activity.

* A slush fund may be used to bribe public officials or other individuals.

* A slush fund may be used to fund political campaigns or other activities that are not in the public interest.

Slush funds are often created by government officials, political candidates, and corporations. They can be used to pay for anything from personal expenses to illegal bribes. Slush funds can be very difficult to detect, and they can pose a serious threat to the integrity of government and the free market.

VII. Legal Implications of Slush Funds

Slush funds can have a number of legal implications, depending on the circumstances surrounding their creation and use. Some of the potential legal problems associated with slush funds include:

- Tax evasion

- Bribery

- Embezzlement

- Fraud

- Money laundering

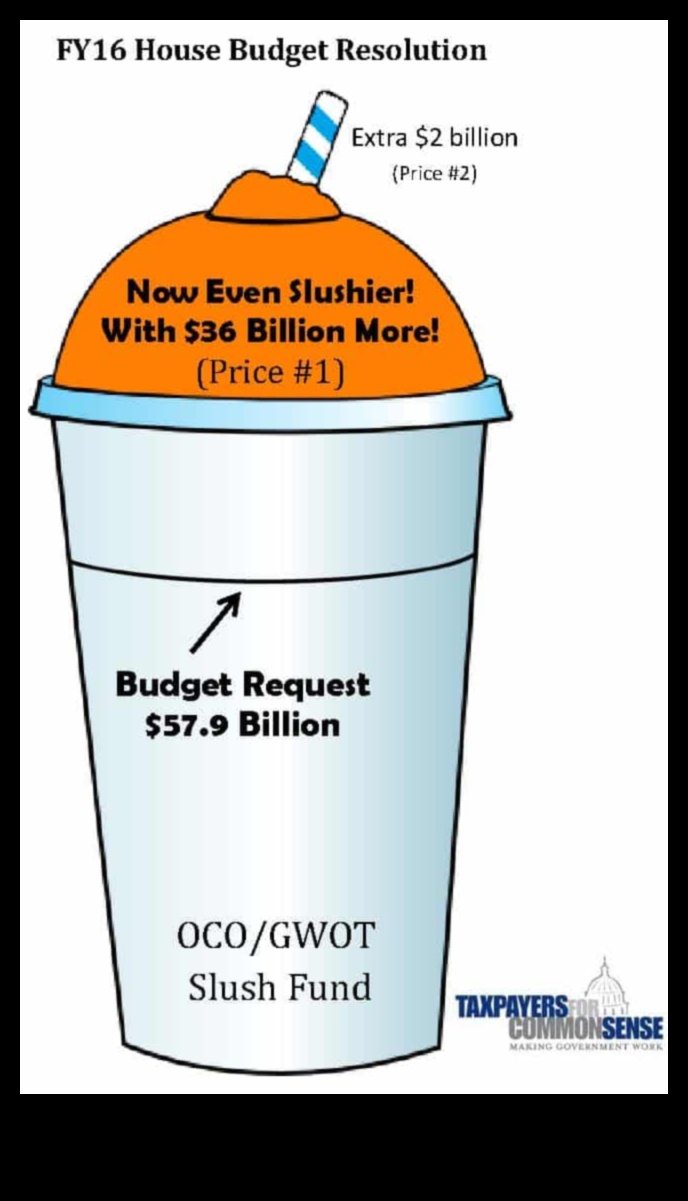

In some cases, slush funds may also be used to circumvent laws or regulations that govern the use of public funds. For example, a government official may use a slush fund to pay for personal expenses that are not allowed under the law.

If you are involved in a slush fund, it is important to be aware of the potential legal implications. You should consult with an attorney to understand your rights and obligations under the law.

Slush Funds in the News

Slush funds have been in the news in recent years due to a number of high-profile scandals. In 2016, for example, it was revealed that the Trump Organization had used a slush fund to pay hush money to women who had accused Donald Trump of sexual assault. In 2017, it was also revealed that the Russian government had used a slush fund to finance its interference in the 2016 US presidential election.

Slush funds are often used to hide illegal or unethical activities. They can be used to pay bribes, kickbacks, or other forms of corruption. They can also be used to fund political campaigns or other activities that would not be approved by the public.

The use of slush funds is a serious problem that can have a negative impact on society. It can lead to corruption, fraud, and other forms of financial crime. It can also undermine democracy and the rule of law.

It is important to be aware of the dangers of slush funds and to take steps to prevent them from being used. Companies and organizations should have strong financial controls in place to prevent the misuse of funds. Governments should also take steps to crack down on the use of slush funds.

IX. Conclusion

Slush funds are a form of financial fraud that can be used to embezzle money, avoid taxes, and conceal illegal activity. They can be created by individuals, businesses, and organizations, and they can be used for a variety of purposes.

Slush funds are a serious problem that can have a significant impact on the economy and society. They can undermine trust in businesses and organizations, and they can lead to corruption and other forms of financial crime.

It is important to be aware of the risks of slush funds and to take steps to prevent them from being created. By understanding the warning signs and being vigilant, you can help to protect yourself from this type of financial fraud.

X. FAQ

Q: What is a slush fund and how does it work?

A: A slush fund is a pool of money that is set aside for discretionary use. It is typically used to pay for expenses that are not authorized by the organization’s budget or that are considered to be too sensitive to be disclosed publicly.

Q: What are the different types of slush funds?

A: There are many different types of slush funds, but some of the most common include:

- Operating slush funds: These funds are used to cover day-to-day expenses that are not included in the organization’s budget.

- Political slush funds: These funds are used to support political campaigns or other political activities.

- Kickback slush funds: These funds are used to pay kickbacks to employees or contractors in exchange for favorable treatment.

- Emolument slush funds: These funds are used to pay for personal expenses of the organization’s leaders.

Q: What are the potential risks and benefits of using a slush fund?

The potential risks of using a slush fund include:

- Corruption: Slush funds can be used to facilitate corruption by providing a way to pay for bribes or other illegal activities.

- Financial mismanagement: Slush funds can be used to mismanage funds by spending them on unauthorized or unnecessary expenses.

- Legal liability: Slush funds can expose organizations to legal liability if they are used to pay for illegal activities or if they are not properly accounted for.

The potential benefits of using a slush fund include:

- Flexibility: Slush funds can be used to cover expenses that are not anticipated or that are not authorized by the organization’s budget.

- Speed: Slush funds can be used to make payments quickly and without the need for approval from multiple levels of management.

- Secrecy: Slush funds can be used to pay for sensitive expenses that the organization does not want to disclose publicly.