What is an Equity Fund?

An equity fund is a type of mutual fund that invests in stocks. Equity funds can be either actively managed or passively managed. Actively managed equity funds are managed by a professional investment manager who selects stocks based on their individual research and analysis. Passively managed equity funds track a specific index, such as the S&P 500, and do not involve any active stock selection.

Equity funds are a popular investment option for investors who are looking for long-term growth. Equity funds can provide higher returns than other types of investments, such as bonds or money market funds, but they also carry more risk.

There are many different types of equity funds available, each with its own unique risk and return profile. Investors should carefully consider their investment goals and risk tolerance before choosing an equity fund.

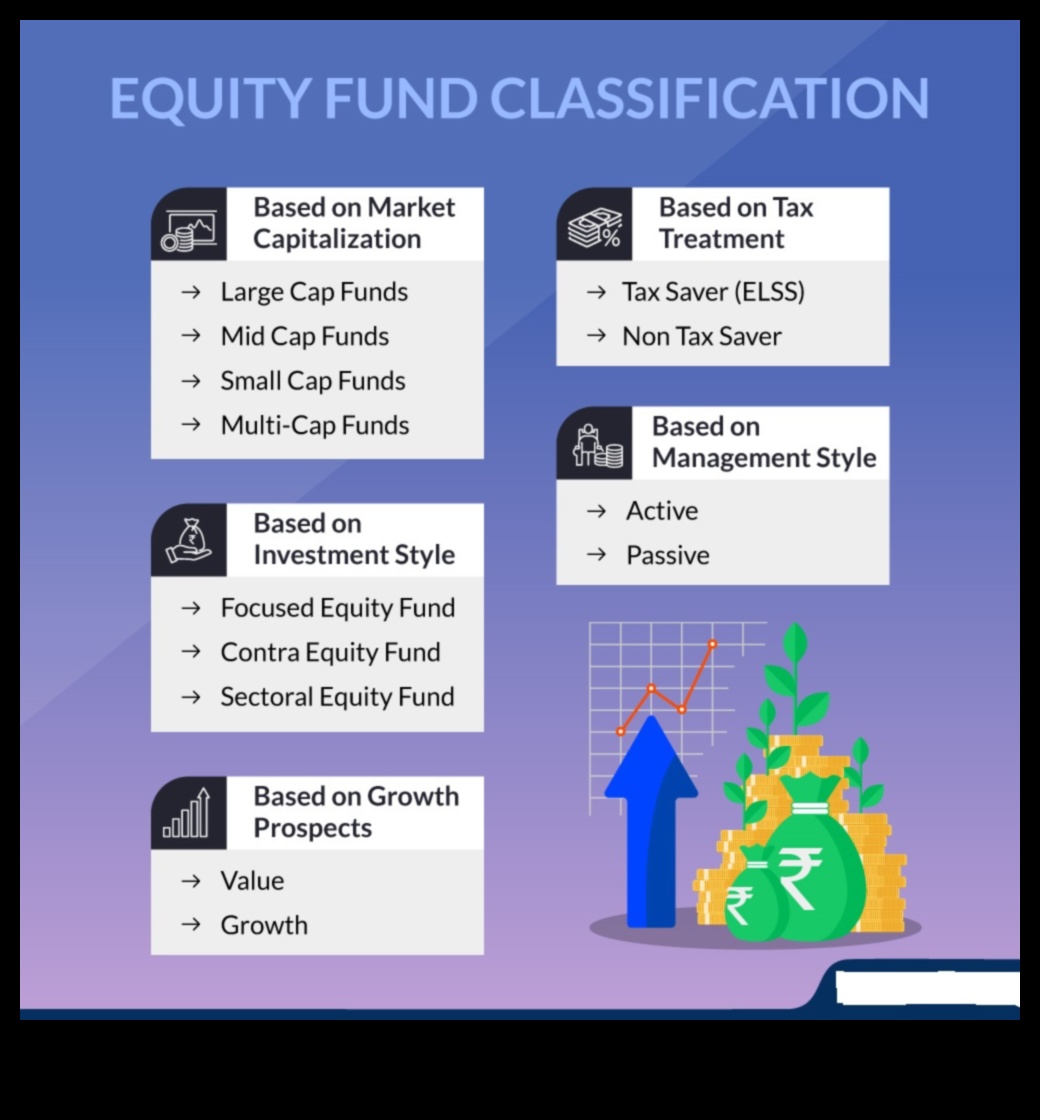

Types of Equity Funds

There are many different types of equity funds available, each with its own unique risk and return profile. Some of the most common types of equity funds include:

- Large-cap funds: These funds invest in stocks of large companies. Large-cap funds are typically less volatile than other types of equity funds, but they also tend to offer lower returns.

- Mid-cap funds: These funds invest in stocks of mid-sized companies. Mid-cap funds are typically more volatile than large-cap funds, but they also offer the potential for higher returns.

- Small-cap funds: These funds invest in stocks of small companies. Small-cap funds are the most volatile type of equity fund, but they also offer the potential for the highest returns.

- International funds: These funds invest in stocks of companies located outside of the United States. International funds can provide diversification and the potential for higher returns than U.S.-based funds, but they also carry more risk.

- Sector funds: These funds invest in stocks of companies in a specific industry or sector. Sector funds can offer the potential for higher returns than broad-based equity funds, but they also carry more risk.

How Equity Funds Work

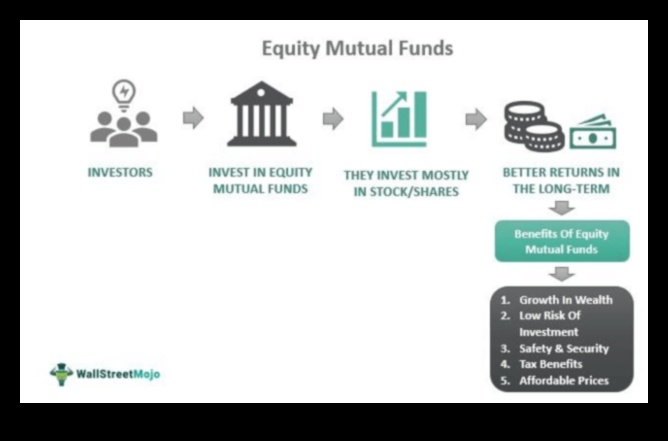

Equity funds work by pooling money from investors and investing it in a diversified portfolio of stocks. The goal of an equity fund is to generate long-term capital appreciation by investing in stocks that are expected to grow in value over time.

Equity funds are typically managed by a professional investment manager who selects stocks based on their individual research and analysis. The investment manager will consider a variety of factors when selecting stocks, including the company’s financial health, its growth prospects, and its competitive position.

Equity funds can be either actively managed or passively managed. Actively managed equity funds are managed by a professional investment manager who selects stocks based on their individual research and analysis. Passively managed equity funds track a specific index, such as the S&P 500, and do not involve any active stock selection.

Benefits of Investing in Equity Funds

There are many benefits to investing in equity funds, including:

- Diversification: Equity funds provide diversification, which can help to reduce risk. By investing in a diversified portfolio of stocks, investors can reduce their exposure to any single stock or industry.

- Potential for growth: Equity funds offer the potential for long-term growth. Over the long term, stocks have historically outperformed other asset classes, such as bonds or money market funds.

- Professional management: Equity funds are typically managed by professional investment managers who have the experience and expertise to select stocks that are likely to outperform the market.

Risks of Investing in Equity Funds

There are also some risks associated with investing in equity funds, including:

- Volatility: Equity funds can be volatile, which means that their value can fluctuate significantly over time. This can make them a risky investment for investors who are not comfortable with market fluctuations.

- Loss of principal: There is always the risk of losing money when investing in equity funds. This is because the value of stocks can go down as well as up.

- Management fees: Equity funds typically charge management fees, which can reduce the returns that investors earn.

How to Choose an

| Feature | Equity Fund | Investment Fund | Mutual Fund | Stock Market | Return on Investment |

|---|---|---|---|---|---|

| Definition | An equity fund is a type of investment fund that invests in stocks. | An investment fund is a pool of money invested by multiple investors. | A mutual fund is a type of investment fund that pools money from investors and invests it in stocks, bonds, and other securities. | The stock market is a place where stocks are bought and sold. | The return on investment (ROI) is the profit or loss an investor makes on an investment. |

| Types | There are many different types of equity funds, including: | There are many different types of investment funds, including: | There are many different types of mutual funds, including: | There are many different types of stock markets, including: | The return on investment (ROI) can vary depending on the type of investment. |

| How they work | Equity funds work by investing in stocks. The fund manager will choose stocks that they believe will perform well in the long term. | Investment funds work by pooling money from multiple investors and investing it in a variety of assets, such as stocks, bonds, and real estate. | Mutual funds work by pooling money from multiple investors and investing it in a variety of stocks, bonds, and other securities. | The stock market works by allowing buyers and sellers to trade stocks. | The return on investment (ROI) is the profit or loss an investor makes on an investment. |

| Benefits | Equity funds offer a number of benefits, including: | Investment funds offer a number of benefits, including: | Mutual funds offer a number of benefits, including: | The stock market offers a number of benefits, including: | The return on investment (ROI) can vary depending on the type of investment. |

| Risks | Equity funds do carry some risks, including: | Investment funds do carry some risks, including: | Mutual funds do carry some risks, including: | The stock market does carry some risks, including: | The return on investment (ROI) can vary depending on the type of investment. |

II. Types of Equity Funds

There are many different types of equity funds, each with its own unique characteristics. Some of the most common types of equity funds include:

- Stock funds invest in stocks of individual companies.

- Mutual funds pool money from investors and invest in a variety of stocks, bonds, and other securities.

- Exchange-traded funds (ETFs) trade on stock exchanges like stocks and track the performance of an underlying index.

- Index funds track the performance of a specific index, such as the S&P 500 or the Dow Jones Industrial Average.

- Sector funds invest in stocks of companies in a particular industry, such as technology or healthcare.

- Thematic funds invest in stocks of companies that are focused on a particular theme, such as sustainability or artificial intelligence.

Each type of equity fund has its own unique risk-return profile. Stock funds and mutual funds typically have higher risk and higher potential returns than ETFs and index funds. Sector funds and thematic funds can have even higher risk, but they also offer the potential for higher returns.

When choosing an equity fund, it is important to consider your risk tolerance and investment goals. If you are looking for a safe investment with low risk, then an index fund or ETF may be a good option. If you are willing to take on more risk in exchange for the potential for higher returns, then a stock fund or mutual fund may be a better choice.

III. How Equity Funds Work

Equity funds invest in stocks, which are shares of ownership in a company. When you buy shares of a company, you are essentially becoming a part-owner of that company. The value of your shares will go up and down depending on the performance of the company.

Equity funds can be either actively managed or passively managed. Actively managed funds have a manager who makes decisions about which stocks to buy and sell. Passively managed funds simply track a specific index, such as the S&P 500.

Equity funds can be a good way to diversify your portfolio and achieve long-term growth. However, they do carry some risk, as the value of your shares can go down as well as up.

Here are some of the benefits of investing in equity funds:

- Diversification: Equity funds can help you diversify your portfolio by investing in a variety of different companies. This can help to reduce your risk.

- Potential for long-term growth: Equity funds have the potential to grow over the long term, as the value of the companies they invest in typically increases over time.

- Professional management: Equity funds are typically managed by professional investment managers who have the experience and expertise to make sound investment decisions.

Here are some of the risks of investing in equity funds:

- Volatility: The value of equity funds can go up and down, which can make them a risky investment.

- Loss of principal: You could lose all of your investment if the companies you invest in go bankrupt.

- Taxes: You may have to pay taxes on your investment gains.

IV. Benefits of Investing in Equity Funds

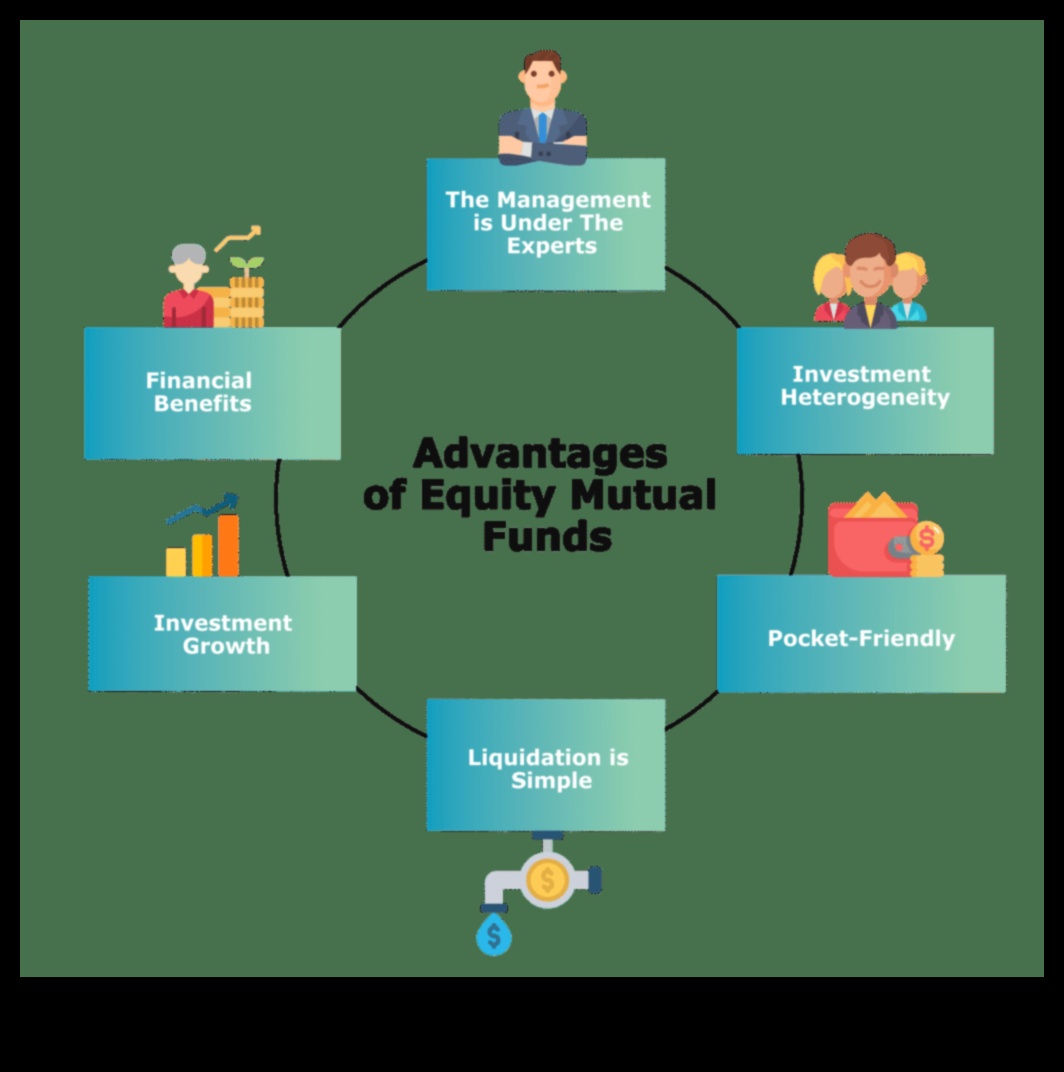

There are many benefits to investing in equity funds, including:

- Potential for high returns

- Diversification

- Professional management

- Liquidity

Let’s take a closer look at each of these benefits.

Potential for high returns

Equity funds have the potential to generate higher returns than other types of investments, such as bonds or money market funds. This is because equity funds invest in stocks, which have the potential to appreciate in value over time.

Diversification

Equity funds can help to diversify your portfolio and reduce your risk. By investing in a variety of stocks, you can help to protect your investments from the volatility of any single stock.

Professional management

Equity funds are managed by professional investment managers who have the expertise and experience to select stocks that are likely to perform well. This can give you the peace of mind knowing that your investments are being managed by experts.

Liquidity

Equity funds are liquid investments, which means that you can easily sell your shares if you need to access your money. This is in contrast to some other types of investments, such as real estate, which can be difficult to sell quickly.

Overall, equity funds offer a number of benefits that can make them a good investment option for many investors. However, it is important to remember that there is no guarantee of returns and that equity funds can also lose value.

V. Risks of Investing in Equity FundsThere are a number of risks associated with investing in equity funds, including:

- Market risk: The value of an equity fund can go down as well as up, and there is no guarantee that you will get back your original investment.

- Liquidity risk: Equity funds can be illiquid, meaning that it may be difficult to sell your shares quickly if you need to.

- Volatility risk: The value of an equity fund can fluctuate significantly from day to day, week to week, and month to month.

- Diversification risk: If you invest in a single equity fund, you are not diversified and your portfolio is exposed to the risk of a single company or sector.

- Management risk: The performance of an equity fund is dependent on the skill of the fund manager. If the fund manager leaves or is replaced, the performance of the fund may suffer.

It is important to be aware of these risks before investing in an equity fund.

VI. How to Choose an Equity FundThere are a number of factors to consider when choosing an equity fund, including:

- Your investment goals and time horizon

- Your risk tolerance

- The fees and expenses associated with the fund

- The fund’s performance history

- The fund’s investment strategy

Once you have considered these factors, you can start to narrow down your choices. You can do this by reading fund prospectuses, talking to your financial advisor, or doing your own research.

When you are ready to invest in an equity fund, you can do so through a brokerage account. You can either buy shares of the fund directly or you can invest in a mutual fund that holds shares of the fund.

Investing in equity funds can be a great way to diversify your portfolio and grow your wealth over the long term. However, it is important to remember that there is always risk involved with investing, and you should never invest more than you can afford to lose.

VII. How to Invest in an Equity Fund

There are a few different ways to invest in an equity fund. You can invest directly through a broker, or you can invest through a retirement plan such as a 401(k) or IRA.

To invest directly through a broker, you will need to open an account and then select the equity fund you want to invest in. You can then make regular contributions to the fund or invest a lump sum.

If you are investing through a retirement plan, your employer will typically provide you with a list of investment options. You can choose to invest in one or more equity funds, as well as other types of investments such as bonds and money market funds.

Once you have selected the equity fund(s) you want to invest in, you will need to decide how much money you want to invest. You can invest as little as $100 in most equity funds.

It is important to remember that investing in equity funds is not without risk. The value of your investment can go up or down, and you may lose money. However, over the long term, equity funds have historically outperformed other types of investments such as bonds and money market funds.

If you are considering investing in an equity fund, it is important to do your research and understand the risks and rewards involved. You should also speak with a financial advisor to get personalized advice on your investment goals.

Performance of Equity Funds

Equity funds can be a volatile investment, and their performance can vary significantly from year to year. However, over the long term, equity funds have historically outperformed other asset classes, such as bonds and cash.

There are a number of factors that can affect the performance of an equity fund, including the following:

- The overall performance of the stock market

- The specific stocks held by the fund

- The fund’s investment style

- The fund’s management fees

It is important to note that past performance is not necessarily indicative of future results. When considering an equity fund, it is important to look at the fund’s performance over a long period of time, as well as its risk profile.

In general, equity funds that invest in small-cap stocks or stocks of companies in emerging markets tend to be more volatile than funds that invest in large-cap stocks or stocks of companies in developed markets. However, they also tend to offer higher potential returns.

When choosing an equity fund, it is important to consider your investment goals and risk tolerance. If you are looking for a long-term investment that can potentially provide high returns, then an equity fund may be a good option for you. However, if you are not comfortable with the risk of losing money, then you may want to consider investing in a more conservative asset class, such as bonds or cash.

IX. Taxation of Equity Funds

Equity funds are taxed as ordinary income, which means that they are taxed at the same rate as your other income. This includes dividends, capital gains, and any other income that the fund generates.

However, there are some exceptions to this rule. For example, long-term capital gains are taxed at a lower rate than ordinary income. This means that if you hold an equity fund for more than a year, you will pay a lower tax rate on any capital gains that you realize when you sell the fund.

In addition, some equity funds may be eligible for special tax treatment. For example, exchange-traded funds (ETFs) that track an index of stocks are often taxed at a lower rate than traditional mutual funds.

It is important to consult with a tax professional to determine how your equity funds will be taxed.

X. FAQ

Q: What is an equity fund?

A: An equity fund is a type of investment fund that invests in stocks.

Q: What are the different types of equity funds?

A: There are many different types of equity funds, each with its own unique investment objectives and strategies. Some of the most common types of equity funds include:

* Large-cap funds: These funds invest in stocks of large companies with a market capitalization of $10 billion or more.

* Mid-cap funds: These funds invest in stocks of mid-sized companies with a market capitalization of between $2 billion and $10 billion.

* Small-cap funds: These funds invest in stocks of small companies with a market capitalization of less than $2 billion.

* Growth funds: These funds invest in stocks of companies that are expected to grow rapidly over time.

* Value funds: These funds invest in stocks of companies that are trading at a discount to their intrinsic value.

* International funds: These funds invest in stocks of companies that are based outside of the United States.

* Sector funds: These funds invest in stocks of companies in a particular industry or sector.

Q: What are the benefits of investing in equity funds?

A: There are many benefits to investing in equity funds, including:

* Diversification: By investing in a variety of stocks, equity funds can help to reduce the risk of your portfolio.

* Potential for growth: Over the long term, equity funds have the potential to generate higher returns than other types of investments, such as bonds or cash.

* Professional management: Equity funds are managed by professional investment managers who have the experience and expertise to select stocks that are likely to outperform the market.

Q: What are the risks of investing in equity funds?

A: There are also some risks associated with investing in equity funds, including:

* Volatility: The value of equity funds can fluctuate significantly over time, and you may lose money if you sell your shares when the market is down.

* Inflation risk: Over time, the value of your money will decrease due to inflation. Equity funds can help to protect your portfolio from inflation by generating returns that are higher than the rate of inflation.

* Liquidity risk: Equity funds may not be as liquid as other types of investments, such as cash or bonds. This means that it may be difficult to sell your shares quickly if you need to do so.